Shop Guaranteed Income for Retirement Instantly

We believe allowing millions to enjoy a carefree retirement by defining and protecting results. First step is to find the best annuity income rates and to receive a FREE instant personalized quote. Let us shop more than 30 annuity carriers for you online.

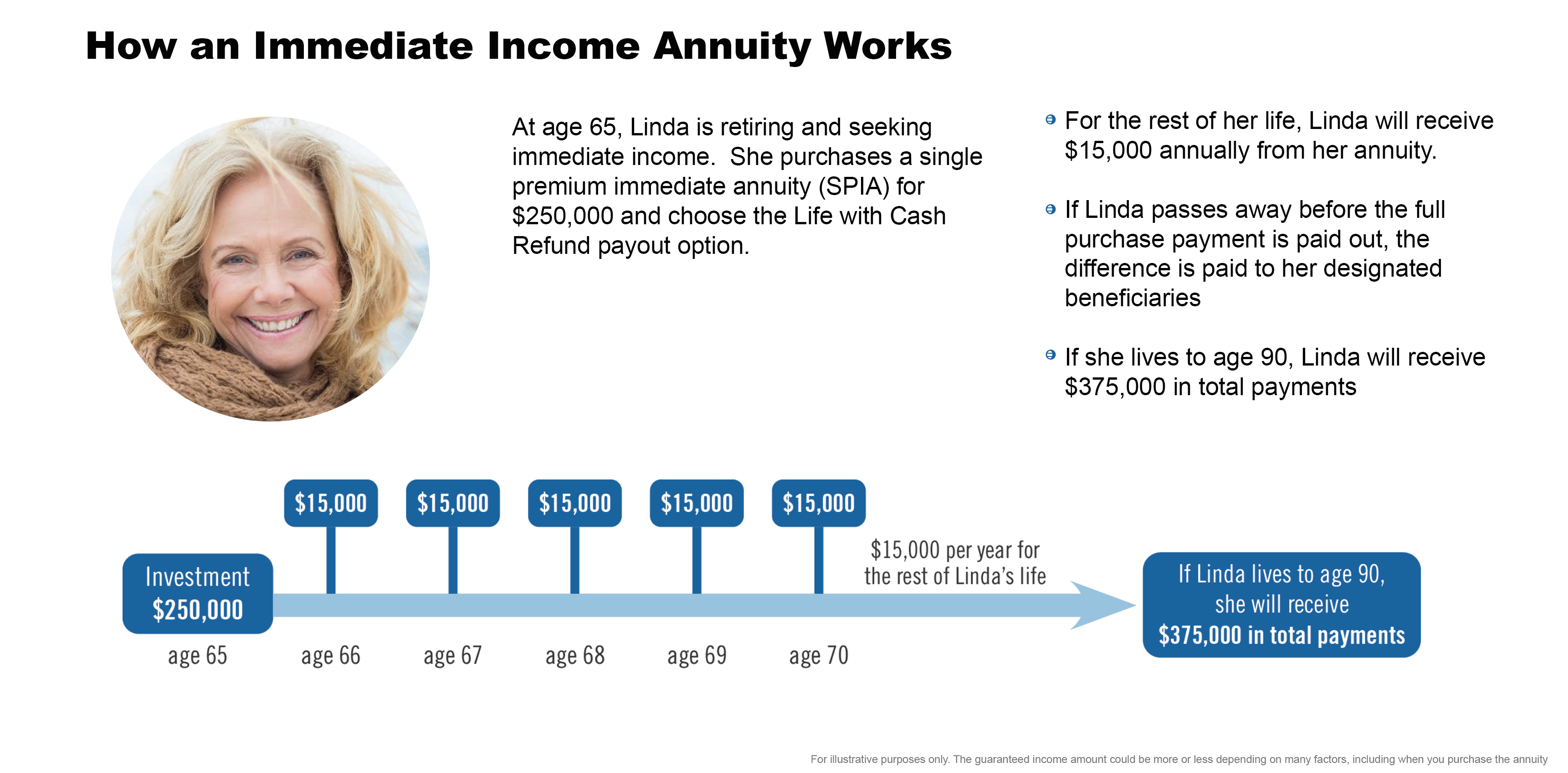

A guaranteed income annuity provides you with a worry-free stream of guaranteed income. An income annuity, as known as a single premium income annuity (SPIA), can be purchased before or after retirement. The money in the annuity— which is invested as a lump sum or in a series of payments, generates a stream of income paid out to the policyholder for life. The amount of income received depends on several factors, including the age, gender, premium amount, and the chosen payout option. We offer over 30 annuity carriers that have several types of guaranteed income annuities to match the needs of retirees. Depending on the one selected, you can begin receiving income immediately or as far out as 40 years. Once it starts, this income will last for life. It is your money, so you have some additional access to it as well. And you can further maximize the guaranteed income by adding additional features to your annuity.